Give back to get back.

Empower education in your community.

Enjoy bigger savings on your tax bill.

What is GO for Shawnee?

You pay state income taxes to support public schools. What if you could specify which communities you support? Now you can!

When you give to

GO for Shawnee Education Tax Credit Fund, you empower education and support students in your community — and get a tax credit too!

GO for Shawnee is great for...

How it works.

Transform your state income tax dollars into funding for Shawnee Public Schools. You’ll help students, families, teachers, and the community, plus get a tax credit, which saves you more than a tax deduction.

Two Contribution Options

Your support makes a difference!

Two-Year Contribution

Make a two-year contribution, get

75%

of your contribution as a state income tax credit each year.

One-Year Contribution

Make a single contribution, get

50%

of your contribution as a state income tax credit each year.

Three Contributor Types

(based on tax filing status)

Individuals

Earn up to

$1,000

each year

Married Couples

Earn up to

$2,000

each year

Businesses

Earn up to

$100K

each year

A message from our Superintendent.

Shawnee Public Schools Community,

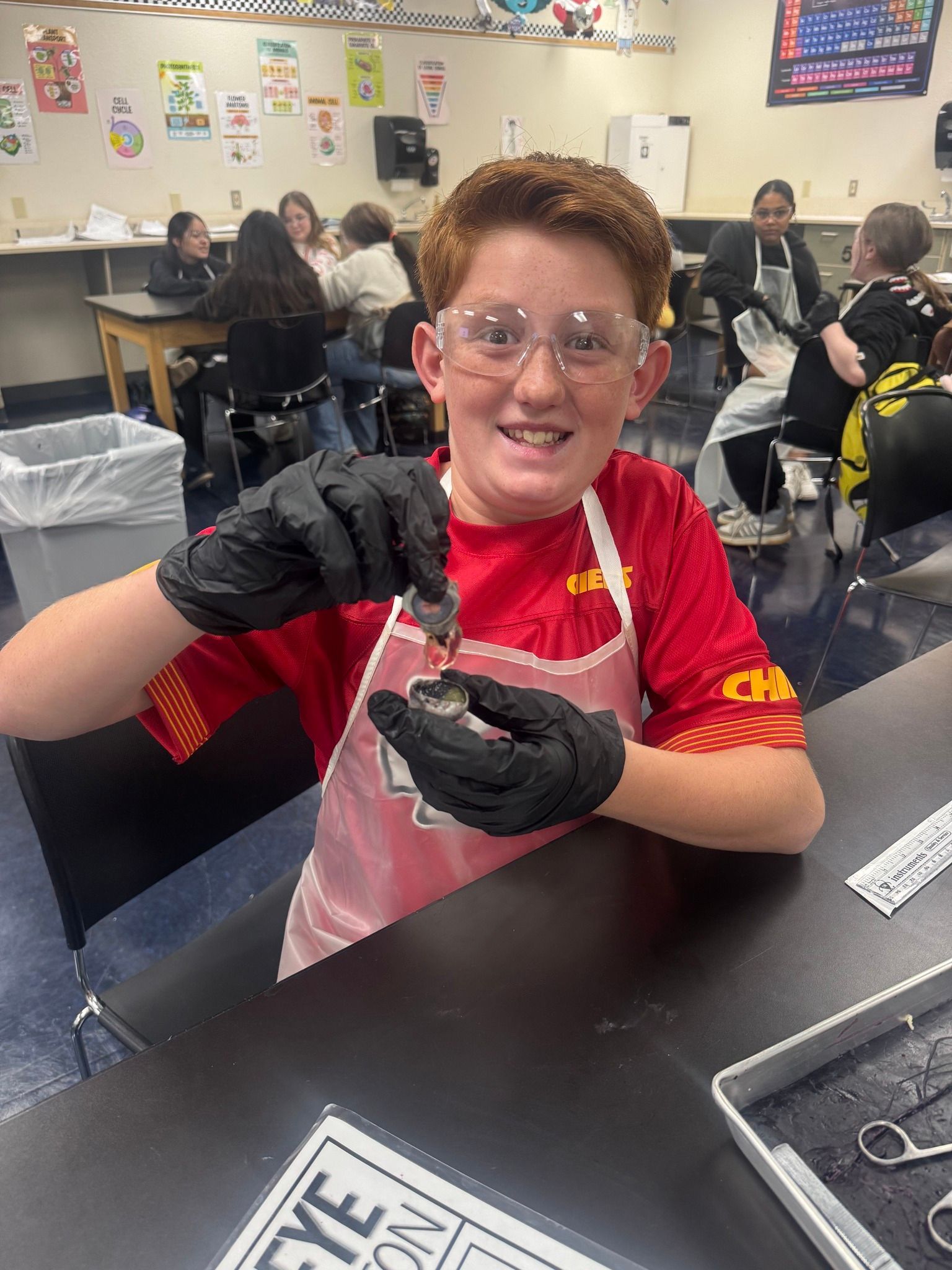

Public schools play a vital role in strengthening our community, ensuring every child has access to a high-quality education that prepares them for lifelong success. Here in Shawnee, the work we do each day for our Wolves is made possible because of the incredible support of our families, partners, and broader community.

I’m excited to share that Shawnee Public Schools is partnering with the experts at GO for Public Schools to launch the GO for Shawnee Education Tax Credit Fund. This initiative makes it easier than ever for our community to directly support Shawnee students, teachers, and classrooms through Oklahoma’s education tax credit program.

GO for Shawnee is a powerful opportunity for all of us. By contributing to the fund, donors can take advantage of valuable state income tax credits, while also bringing those tax dollars back home to strengthen our schools. Every contribution helps us build a new, sustainable, and locally driven source of support that will benefit Shawnee students now and for years to come.

As we continue to grow, rebuild, and reimagine what’s possible for the Shawnee Wolves, community partnerships like this make all the difference. I am consistently inspired by the pride and commitment shown by our families, staff, and neighbors as we work together to provide the very best for our students.

Thank you for standing with us. Please consider contributing to the GO for Shawnee Education Tax Credit Fund this year, and help us continue moving Shawnee Public Schools forward.

Go Wolves!

Dr. Jason James

Superintendent

Shawnee Public Schools

GO for Shawnee FAQs

Our 2025 Contribution Goal

$250k